- Sector Expertise

Automated KYC Processes

We design solutions that automate the customer onboarding process, verifying identities through document recognition, biometric authentication, and global databases.

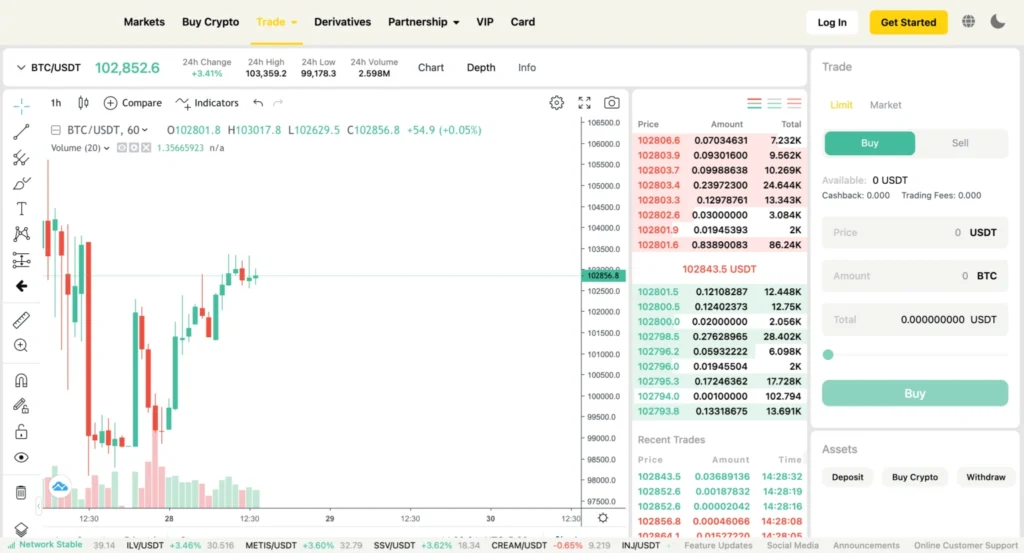

AML Transaction Monitoring

Our AML systems analyze transactions in real-time, flagging suspicious activities and patterns to prevent financial crimes.

Regulatory Compliance Management

We implement tools to ensure compliance with global and regional regulations, including FATF, FINRA, and GDPR, reducing the risk of penalties.

Risk Scoring and Profiling

Our solutions assess customer risk levels based on behavior, geographic location, and transaction history, enabling smarter decision-making.

How we help

Our KYC & AML Solutions empower businesses to:

Automate identity verification to enhance the customer onboarding experience.

Stay ahead of global regulatory standards with built-in compliance frameworks.

Identify and mitigate risks associated with money laundering and financial crimes.

Leverage advanced analytics to assess risk and fraud effectively.

100+

1M+

Our process

Requirement Analysis

We begin by understanding your compliance needs and the regulatory requirements you must adhere to for KYC (Know Your Customer) and AML (Anti-Money Laundering). This helps us create a customized solution tailored to your business’s risk profile and operational processes.

Solution Design & Integration

Our team designs an end-to-end KYC/AML solution, incorporating identity verification, transaction monitoring, and reporting features. We integrate this solution seamlessly into your existing infrastructure, whether for online onboarding, in-person verification, or customer transactions.

Identity Verification & Document Checks

We implement advanced identity verification methods, including biometric authentication, document verification (e.g., passports, driver’s licenses), and data matching against global watchlists and sanction lists.

AML Transaction Monitoring

Our solution uses AI-driven algorithms to monitor and analyze customer transactions in real-time. We detect suspicious activity, such as money laundering, fraud, or unusual financial patterns, and trigger alerts for further investigation.

Compliance Reporting & Auditing

We create automated systems for generating compliance reports and audit trails. These reports ensure you meet regulatory obligations and provide an easy way to prove due diligence during audits.

Continuous Updates & Adaptation

Regulations are constantly evolving, so our team continuously updates your KYC/AML solution to remain compliant with the latest legal standards. We also provide ongoing support to adjust the system as your business and compliance needs grow.