For founders, CXOs, brokers, and platform leaders, trading platform development cost becomes a serious concern only after initial feasibility is clear. At the decision stage, the discussion shifts from features to long-term ownership, regulatory exposure, and operational risk.

This article explains what truly drives cost in broker-grade trading and reporting systems in 2026. It focuses on architecture, compliance, and scaling realities rather than vendor pricing models.

What makes a trading system broker-grade in 2026?

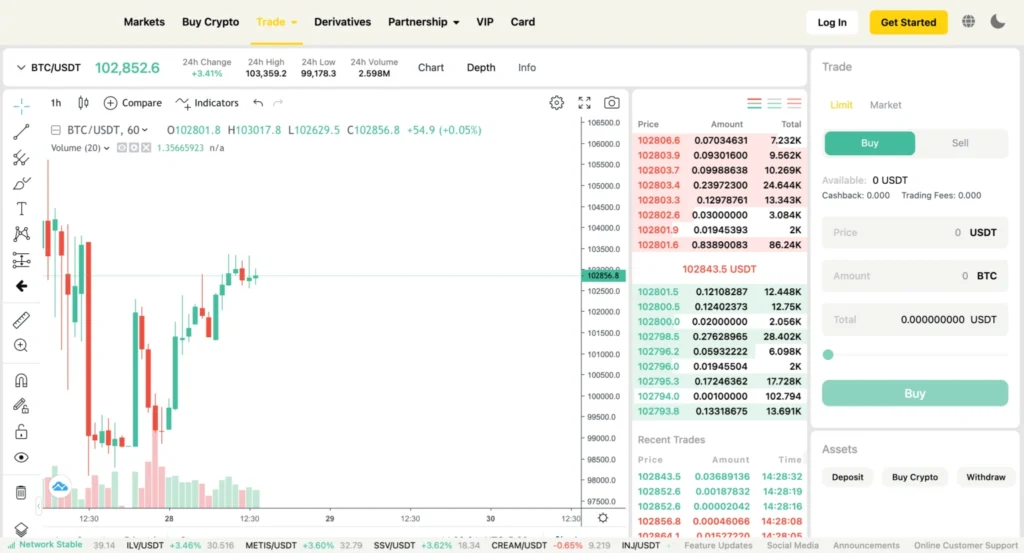

A broker-grade trading system is defined by reliability, traceability, and regulatory readiness. These platforms manage order capture, execution, confirmations, client reporting, and regulator-facing submissions under strict uptime and audit requirements.

A broker-grade system typically supports sub-100 millisecond execution, retains immutable audit logs for 7–10 years, and produces regulatory reports with over 99.9% data accuracy. These requirements alone account for roughly 30–40% of total platform build cost.

Reporting complexity is often underestimated. Regulations such as consolidated audit trail reporting in the US or MiFID II in Europe require precise timestamps, consistent identifiers, and reproducible historical views. This forces early investment in structured data pipelines and validation controls.

How is trading platform development cost distributed across layers?

While total cost varies by scope, broker-grade platforms follow a predictable layered structure. Each layer introduces both build cost and ongoing operational overhead.

In 2026, building a mid-scale broker-grade trading platform typically costs USD 900,000 to USD 2.4 million. Core execution and order management account for 35–45%, compliance and reporting for 25–30%, and infrastructure plus security for 20–25%.

Latency-sensitive execution engines require specialist engineers and careful infrastructure design, increasing cost by 20–30% compared to standard enterprise systems. Market data normalization, risk checks, and reconciliation further add to complexity.

Why do compliance and reporting costs continue after launch?

Compliance spending does not stop at go-live. Regulatory rules evolve, asset coverage expands, and audit expectations increase over time.

Post-launch compliance and reporting typically require USD 120,000–180,000 per year, covering regulatory updates, monitoring, audit support, and data validation tooling.

Regulators such as the U.S. Securities and Exchange Commission and European supervisory bodies regularly update reporting standards. Each update can affect schemas, retention logic, and reconciliation workflows, making compliance a permanent cost center.

When does building make more sense than buying?

Buying a vendor platform reduces initial spend but limits architectural control. Building requires higher upfront investment but allows alignment with internal workflows and long-term strategy.

Building becomes economically justified when customization exceeds 20–25% of a vendor platform or when multi-asset expansion is planned within 24 months.

Firms working with derivatives, digital assets, or hybrid settlement models often reach vendor limits quickly. In these cases, owning core architecture reduces future migration risk.

What hidden costs appear after a platform goes live?

Many costs surface only after real trading volume begins. These are operational rather than development-related.

Mature platforms typically allocate 15–20% of initial build cost annually for infrastructure scaling, resilience testing, incident response, and third-party audits.

High availability, disaster recovery drills, and continuous monitoring become mandatory. Operational load often triples within the first 18 months of production trading, increasing staffing and infrastructure costs.