AI for Wealth Management Operations is changing how mid-size firms manage daily workloads. Rising regulatory demands, tighter margins, and higher client expectations place pressure on operations teams. As a result, firms increasingly rely on AI systems to improve accuracy, speed, and control without expanding headcount.

How does AI improve operational efficiency in wealth management?

Operational teams often struggle with fragmented data, manual reconciliations, and delayed reporting. Artificial intelligence, defined as software that identifies patterns and automates decisions, reduces these gaps by coordinating workflows across systems.

AI automates reconciliation, reporting, and exception handling. Firms typically cut processing time by 45% and reduce reporting cycles from five days to under one day. Error rates also fall by nearly 30% due to consistent validation rules.

Direct answer: AI improves operational efficiency by automating repeatable tasks and identifying anomalies early, resulting in faster reporting and fewer manual errors.

Our experience building financial data analytics platforms for regulated financial teams shows that targeted automation delivers faster returns than full system replacement.

Why is AI becoming essential for compliance and risk monitoring?

Compliance requirements continue to expand, while review timelines shorten. Manual reviews cannot scale reliably as transaction volumes grow.

AI systems monitor transactions continuously and flag unusual patterns in near real time. Mid-size firms reduce compliance review backlogs by 60% and cut false alerts by 25%. Audit preparation time drops from weeks to hours.

Direct answer: AI strengthens compliance by shifting from periodic reviews to continuous monitoring, improving accuracy and audit readiness.

Research published by IEEE shows machine learning improves financial anomaly detection accuracy by over 30% compared to rule-based checks.

How does AI streamline client onboarding and servicing?

Client onboarding often involves manual document checks, identity verification, and risk scoring. These steps create delays and inconsistencies.

AI-based onboarding extracts data from documents, validates identities, and assigns risk profiles automatically. Firms reduce onboarding time from 7–10 days to under 24 hours while lowering processing costs by about 45%.

Direct answer: AI shortens onboarding timelines by automating document and risk checks, allowing faster account activation.

These workflows integrate effectively with systems built through enterprise application development for financial services, ensuring consistency across operations.

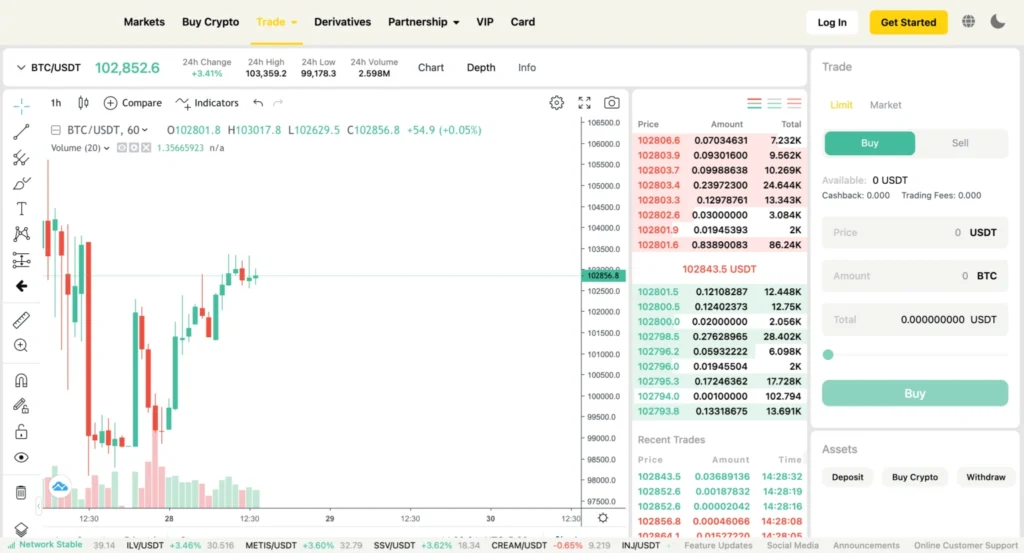

What role does AI play in portfolio monitoring and reporting?

Portfolio oversight requires frequent analysis of performance, risk exposure, and client mandates. Manual reviews limit how often teams can act.

AI-driven monitoring evaluates portfolios daily and generates alerts when thresholds are breached. Firms report a 20–30% reduction in unmanaged risk exposure and faster response to market changes.

Direct answer: AI improves portfolio oversight by enabling daily analysis instead of periodic reviews, reducing risk exposure.

Can AI be adopted without replacing existing systems?

Many mid-size firms worry about disruption during adoption. However, AI systems are usually deployed as modular layers connected through APIs.

This phased approach delivers ROI within 6–9 months. Cost reductions often exceed implementation spend by the second year.

Direct answer: AI adoption works best when layered onto existing platforms, minimizing risk while improving scalability.

Our work in digital transformation programs shows phased deployment improves adoption and long-term stability.

For mid-size firms, AI for Wealth Management Operations supports control, accuracy, and scale. Firms adopting practical AI systems are better prepared for tighter margins and increased regulatory scrutiny.