Fraud investigations often start too late. Traditional monitoring depends on manual review, delayed reports, and scattered alerts. A modern AI fraud detection system changes that timeline. Instead of waiting days for patterns to surface, teams can detect risk in minutes and respond before losses escalate.

How does AI-based monitoring detect fraud faster than manual controls?

Manual fraud checks rely on rules and after-the-fact review. However, fraud evolves faster than static controls. AI-based risk monitoring uses machine learning models trained on transaction history, device signals, and behavioral patterns.

An AI fraud detection system can reduce detection turnaround from 48–72 hours to under 5 minutes by continuously scoring transactions as they occur. This allows compliance teams to act during the transaction window, not after settlement.

Additionally, these systems adapt. When fraud tactics shift, models retrain using recent anomalies. Therefore, detection improves without rewriting hundreds of rules.

Many firms pair this with financial analytics systems for risk signal processing to consolidate data streams and reduce blind spots.

What architecture enables fraud monitoring in minutes instead of days?

Speed depends on architecture, not only algorithms. Real-time fraud platforms are built around streaming pipelines rather than batch reports.

A modern fraud monitoring stack uses event streaming, automated scoring, and case orchestration to cut investigation initiation time from 2–3 days down to under 10 minutes, even at high transaction volume.

A typical architecture includes:

- Streaming ingestion (Kafka, Kinesis)

- Model scoring layer with sub-second latency

- Alert routing into compliance workflows

- Immutable audit logs for regulators

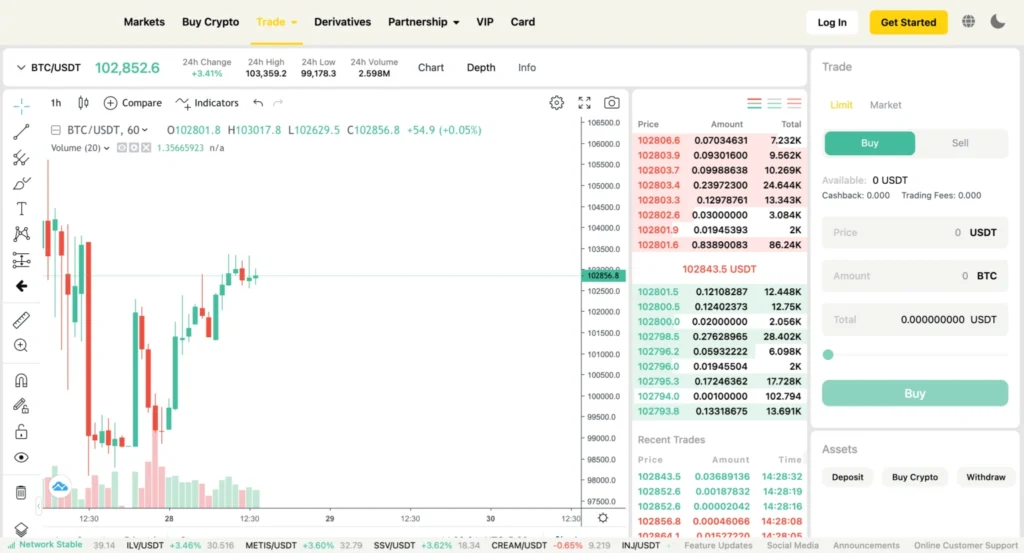

This approach is especially important in crypto exchanges, where withdrawal fraud can occur within minutes. Our experience in exchange development with integrated risk controls shows that real-time monitoring reduces loss exposure sharply.

How does AI help meet compliance and regulatory readiness goals?

Fraud monitoring is not only about stopping losses. It is also about proving control to regulators. Banking and fintech firms must demonstrate traceability, consistency, and documented decision-making.

Direct answer: AI-based monitoring improves regulatory readiness by producing consistent risk scoring, automated case logs, and audit trails that reduce compliance reporting effort by 40–60% during quarterly reviews.

Regulators increasingly expect near-real-time oversight. Guidance from organizations such as FFIEC highlights the need for ongoing monitoring rather than periodic sampling.

Therefore, strong platforms combine AI scoring with workflow governance. Many teams implement this through enterprise workflow platforms that connect risk, operations, and compliance.

What measurable outcomes should decision-makers expect?

Founders and CXOs need business-level clarity. AI fraud detection projects succeed when outcomes are measurable and tied to operations.

Direct answer: Most fraud teams see detection time drop from days to minutes, false positives decline by 20–35%, and investigation workload reduce by 30% within the first 90 days of deployment.

Additionally, faster monitoring improves customer trust. In banking, fewer blocked legitimate transactions can improve retention by 5–8% over a year.

How should firms approach implementation without disrupting operations?

AI monitoring works best as an overlay, not a replacement. The goal is to integrate with existing banking cores, payment gateways, or exchange ledgers.

The most reliable rollout starts with high-risk transaction streams, runs in parallel for 6–8 weeks, and then expands coverage once model precision exceeds 90%.

A phased approach avoids operational shocks. It also allows teams to validate controls with internal audit early.

If you are planning a fraud monitoring upgrade or building a new AI fraud detection system, we can help map the right architecture and compliance controls. Book a consultation with The Fast Way Team to discuss your platform needs.

Frequently Asked Questions

What is an AI fraud detection system?

An AI fraud detection system uses machine learning to identify abnormal financial activity in real time. It scores transactions continuously, reducing fraud response time from days to minutes.

How does AI reduce fraud detection time?

AI models analyze live behavioral and transactional signals. This enables alerts within minutes instead of waiting for batch reviews or manual investigation.

Can AI monitoring support regulatory audits?

Yes. AI systems generate structured case logs, decision traces, and audit-ready reporting. This often reduces compliance preparation effort by 40–60%.

How does AI integrate with existing workflows?

Most platforms connect via APIs into banking cores, exchanges, or ERP systems. Alerts flow into case management tools without replacing existing controls.