- The Story

At The Fast Way, we had the privilege of working with Imperial Assets to bring their groundbreaking vision to life: a platform that tokenizes real-world assets like buildings and land, allowing anyone to invest in small portions of these assets, much like stocks, and earn dividends. By combining blockchain technology with real estate investment, Imperial Assets aims to democratize wealth creation and make property ownership accessible to everyone.

About The Business

Imperial Assets is revolutionizing the investment landscape by bridging the gap between traditional real estate and blockchain technology. Their platform enables users to tokenize high-value assets, such as buildings and land, into smaller, affordable units. This innovative approach allows individuals to invest small amounts in premium assets and earn dividends, making real estate investment more inclusive and liquid.

The Challenge

Imperial Assets needed a platform that could seamlessly tokenize physical assets, ensure compliance with legal frameworks, and provide a user-friendly interface for investors. The challenge was to combine the complexity of blockchain with the simplicity required for mainstream adoption while ensuring the platform’s scalability and security.

Our Approach

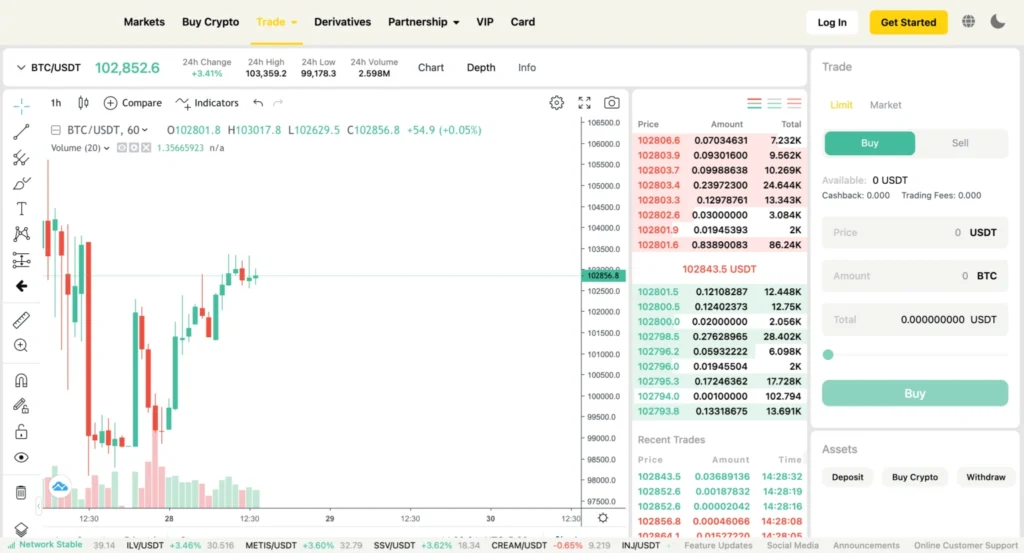

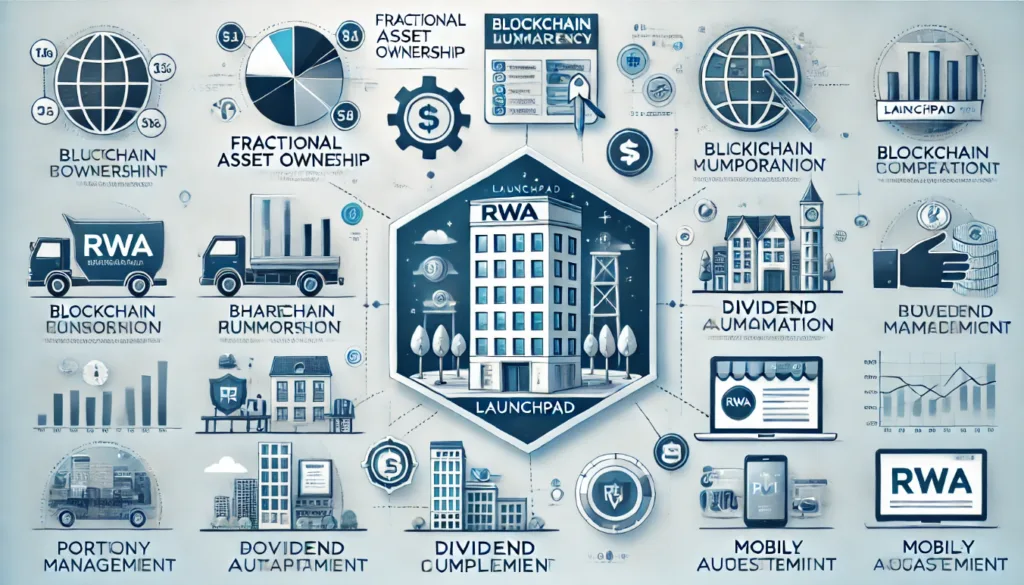

Developed a robust blockchain infrastructure to tokenize real-world assets into fractional shares, ensuring security, transparency, and traceability.

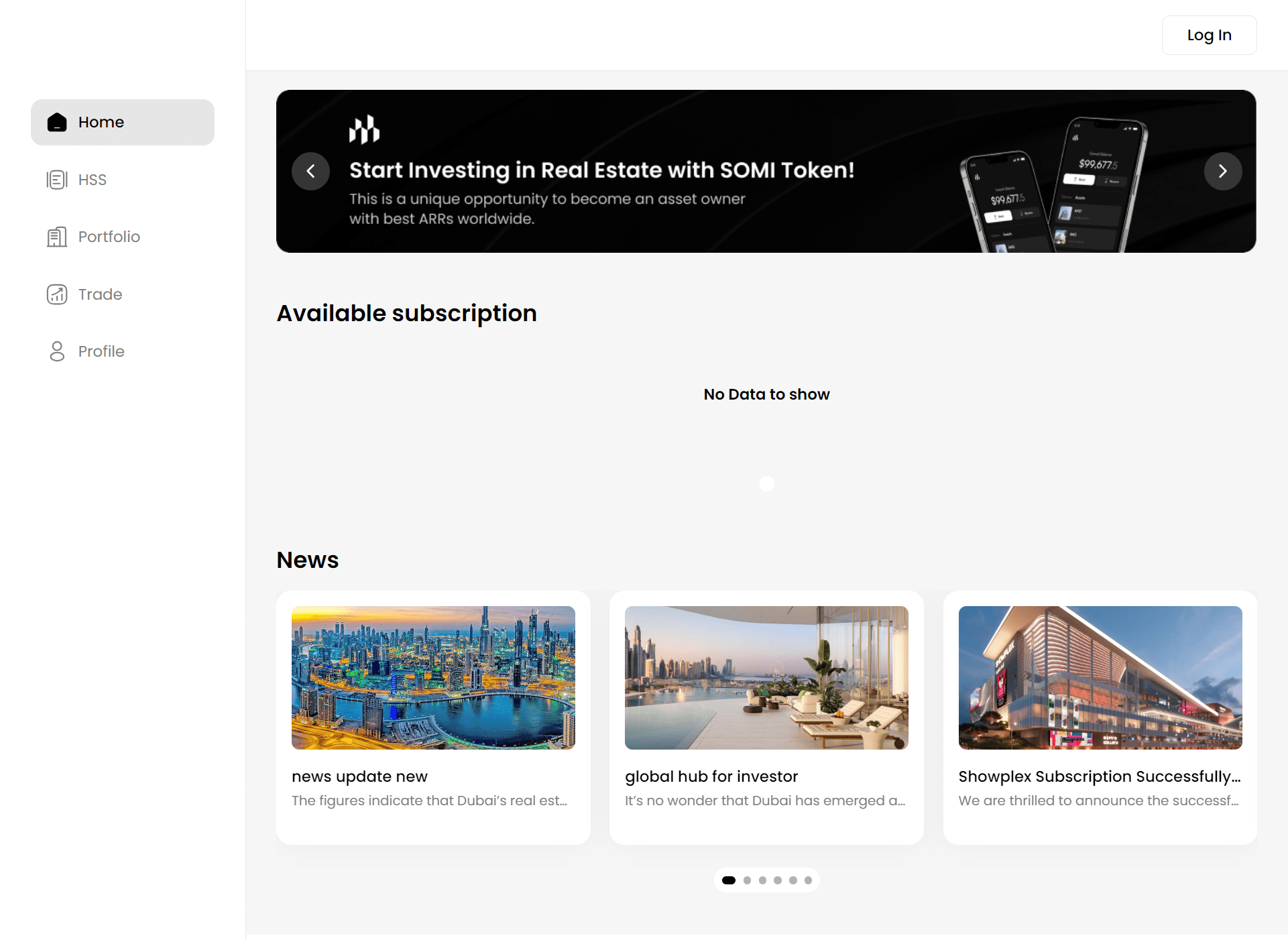

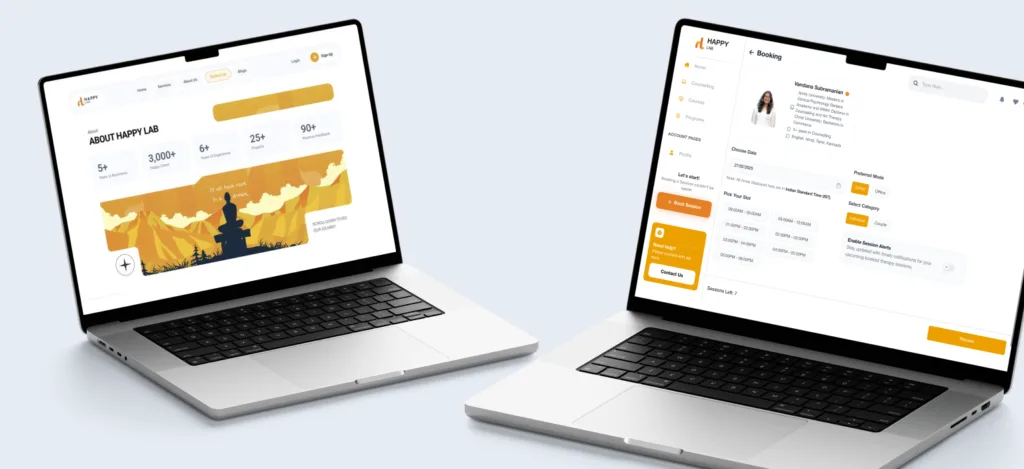

Created an easy-to-use interface for investors to browse assets, purchase fractional shares, and track dividends.

Designed an automated system to distribute dividends to investors based on their holdings.

Integrated compliance mechanisms to ensure adherence to local and international regulations for real estate tokenization.

Developed tools for asset owners to manage their tokenized properties, monitor investments, and engage with investors.

Project Journey

- Discovery and Planning: Worked with Imperial Assets to define project objectives, map out features, and ensure regulatory compliance.

- Design and Prototyping: Developed wireframes and prototypes emphasizing simplicity and functionality for users and asset owners.

- Blockchain Development: Built the core tokenization engine, integrating smart contracts for fractional ownership and dividend distribution.

- Testing and Quality Assurance: Conducted rigorous testing to ensure platform security, scalability, and user-friendliness.

- Launch and Post-Launch Support: Successfully launched the platform and provided ongoing support to implement enhancements based on user feedback.

Challenges Faced

- Regulatory Compliance: Navigating complex legal frameworks for real estate tokenization in different jurisdictions.

- User Education: Simplifying blockchain concepts for users unfamiliar with decentralized technologies.

- Scalability: Ensuring the platform could handle a growing number of users and transactions.

Key Features

- Fractional Asset Ownership: Allows users to invest in small portions of high-value real estate assets.

- Blockchain Transparency: Ensures secure and transparent transactions with immutable smart contracts.

- Dividend Automation: Automates the calculation and distribution of dividends to investors.

- Regulatory Compliance: Built-in tools to ensure adherence to legal and financial regulations.

- Portfolio Management: Offers investors a dashboard to monitor their investments and earnings.

- Mobile Accessibility: Responsive design for seamless access across devices.

Results

Imperial Assets launched as a cutting-edge platform, enabling individuals to invest in tokenized real estate with ease. The platform’s transparency, security, and simplicity have garnered positive feedback, attracting a growing user base of investors and asset owners.

Conclusion

Building Imperial Assets was an exciting journey that allowed us to combine blockchain innovation with the accessibility of real estate investment. By democratizing property ownership, Imperial Assets is paving the way for a future where everyone can participate in wealth creation, one fractional investment at a time.