- Sector Expertise

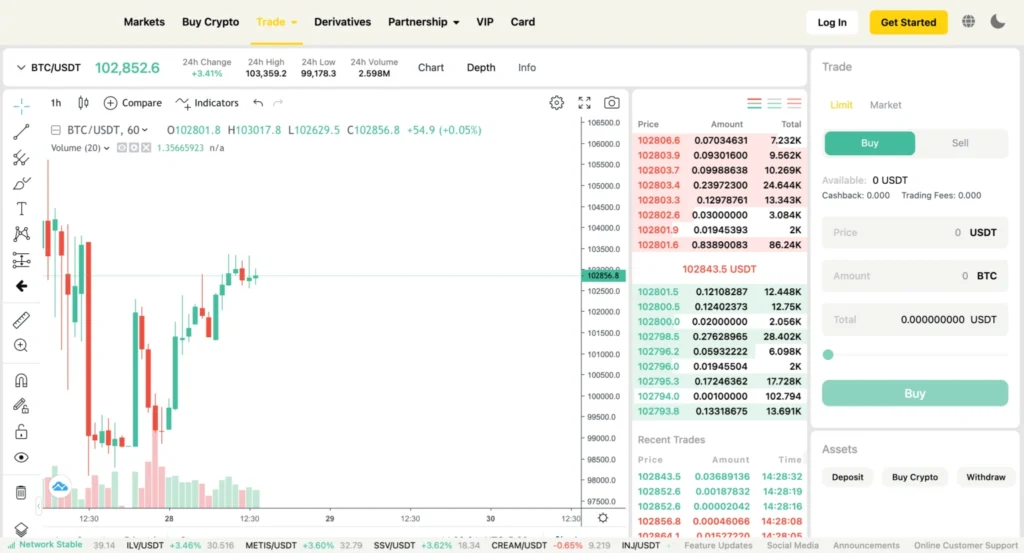

Custom Trading Bot Development

We design and develop trading bots tailored to specific strategies, including arbitrage, scalping, and market making.

Algorithmic Trading Solutions

Our team builds algorithmic trading systems that analyze market data in real time to execute trades based on predefined rules.

Multi-Exchange Integration

We create bots that seamlessly integrate with multiple exchanges, enabling diversified trading and liquidity optimization.

Risk Management Tools

Our bots include built-in risk management features, such as stop-loss, take-profit, and position sizing, to protect investments.

How we help

Our Automated High-Frequency Trading Bots empower traders and businesses to:

Execute trades in microseconds to capitalize on fleeting market opportunities.

Implement complex trading strategies with precision and scalability.

Maximize returns by leveraging real-time data and predictive analytics.

Employ advanced risk management features to protect investments in volatile markets.

100+

1M+

Our process

Understanding Trading Objectives

We begin by identifying your trading strategies, financial goals, and market preferences. Whether you aim for arbitrage, trend-following, or mean-reversion strategies, we tailor the solution to meet your specific needs.

Strategy Design & Backtesting

Our team collaborates with you to design algorithmic trading strategies. These strategies are then rigorously backtested using historical data to ensure their effectiveness and profitability in real-world market conditions.

Developing High-Performance Bots

We build robust and efficient trading bots capable of executing trades at millisecond speeds. Using advanced programming languages like Python, C++, or Java, we ensure low-latency execution and precise algorithm implementation.

Integration with Trading Platforms

The bots are seamlessly integrated with your preferred trading platforms, including exchanges like Binance, Coinbase, or traditional platforms like Interactive Brokers. API integration ensures secure and real-time market connectivity.

Real-Time Monitoring & Optimization

Our solution includes real-time monitoring of bot performance and market conditions. This allows for dynamic adjustments to trading parameters, ensuring consistent performance in changing market environments.

Security & Risk Management

We implement robust security protocols to protect sensitive trading data and accounts. Risk management features, such as stop-loss mechanisms and capital allocation limits, are incorporated to minimize potential losses.