- Sector Expertise

Policy Management Systems

We develop comprehensive systems to manage the entire policy lifecycle, from issuance to renewal, ensuring seamless operations and improved customer satisfaction.

Claims Automation

Our team builds robust claims management platforms that automate processes, reduce turnaround times, and enhance transparency for customers and insurers.

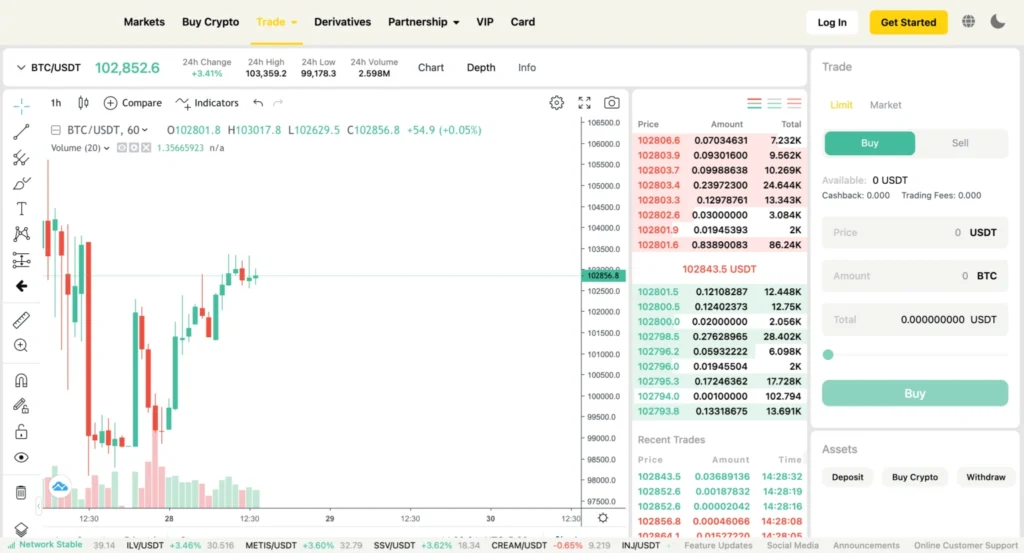

Underwriting Solutions

We deliver intelligent underwriting platforms powered by AI and ML, enabling accurate risk assessment and faster decision-making.

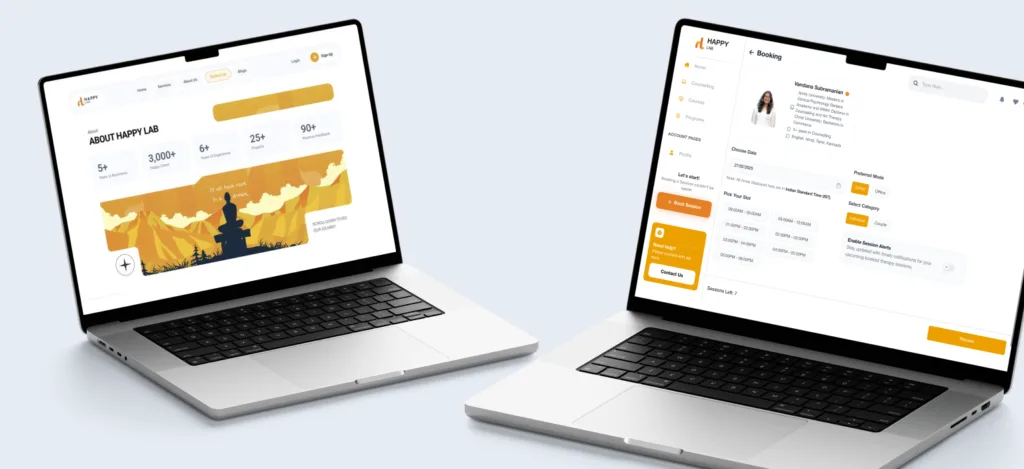

Customer Portals and Mobile Apps

We design user-friendly portals and apps that allow policyholders to access information, submit claims, and manage policies with ease.

How we help

Our Insurance Tech Solutions empower insurers to:

Automate manual processes and improve backend workflows.

Deliver personalized experiences with user-friendly digital platforms.

Minimize delays with streamlined and transparent claims management.

Meet regulatory requirements with built-in compliance frameworks.

100+

1M+

Our process

Understanding Your Insurance Business

We start by analyzing your insurance operations, target audience, and technological needs. This ensures our solutions align with your business goals, whether it’s streamlining claims processing, enhancing customer experience, or automating underwriting.

Designing Tailored Solutions

Our team designs customized Insurance Tech (InsurTech) solutions, integrating advanced technologies such as AI, machine learning, and blockchain. This step ensures scalability, efficiency, and compliance with regulatory standards.

Development & Integration

We develop and implement features like policy management systems, automated claims processing, underwriting platforms, and customer portals. These solutions are seamlessly integrated into your existing ecosystem for a smooth transition.

Advanced Data Analytics

Our InsurTech solutions include data analytics capabilities to derive actionable insights. This helps you assess risks, optimize pricing models, and personalize insurance offerings for your customers.

Security & Compliance

We prioritize data security and compliance with industry regulations (e.g., GDPR, HIPAA). Advanced encryption and secure data management practices ensure the protection of sensitive customer information.

Deployment & Ongoing Support

After deployment, we provide continuous support, updates, and performance monitoring to ensure your InsurTech solutions remain efficient and future-proof. We also offer training for your team to maximize the solution’s impact.