- Sector Expertise

Custom Lending Solutions

We design and develop tailored lending platforms, enabling seamless loan origination, management, and repayment processes.

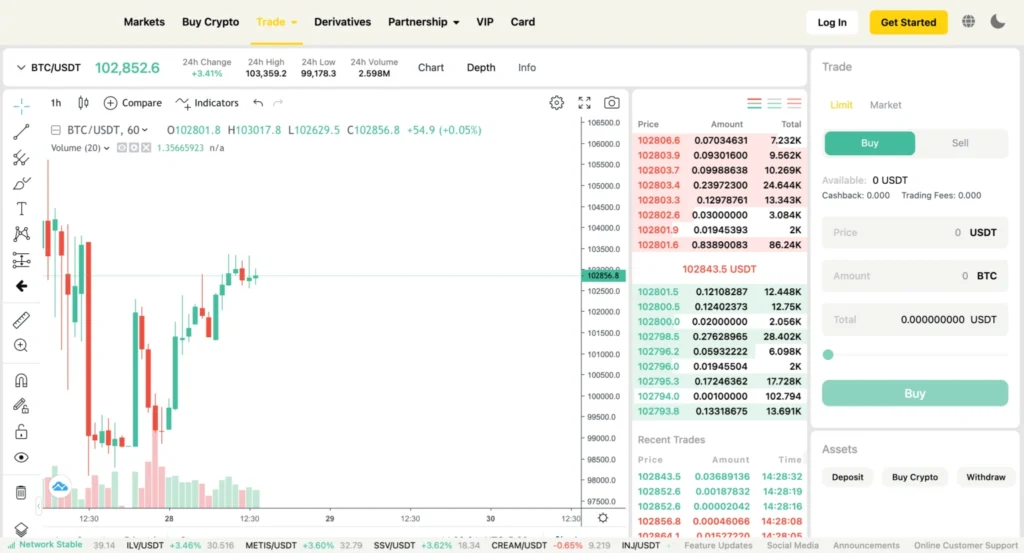

P2P Marketplace Development

Our team creates P2P marketplaces where lenders and borrowers can connect directly, reducing the need for intermediaries.

Smart Contract Integration

We implement blockchain-powered smart contracts to automate loan agreements, ensuring transparency and minimizing risks.

Risk Assessment and Scoring

We integrate advanced analytics and AI tools to assess borrower creditworthiness and calculate risk scores.

How we help

Our P2P & Lending Platform Development services empower businesses and individuals to:

Enable borrowers to access loans quickly and efficiently while providing lenders with new investment opportunities.

Automate loan approvals, disbursements, and repayments for enhanced efficiency.

Leverage blockchain and encryption technologies to protect user data and financial transactions.

Eliminate intermediaries, lowering transaction costs for both lenders and borrowers.

100+

1M+

Our process

Defining Business Objectives

We begin by understanding your vision for the P2P lending platform, identifying the key features you need, such as loan origination, interest rates, credit scoring, and repayment tracking. This ensures we align the platform design with your business goals.

Market & Compliance Research

We conduct in-depth research into the peer-to-peer lending market and ensure compliance with local regulations, including KYC (Know Your Customer) and AML (Anti-Money Laundering) standards. This step guarantees that your platform adheres to legal requirements and industry best practices.

Platform Architecture Design

Our team designs a scalable and secure platform architecture that can handle user registrations, loan applications, contract management, payment processing, and real-time updates. We ensure that the platform supports multiple loan types and repayment methods.

Smart Contract & Integration Development

For decentralized and automated lending, we create secure smart contracts to govern the loan process, including disbursement, interest calculation, and repayment. We also integrate third-party services such as payment gateways, identity verification, and credit scoring APIs.

User Interface & Experience Design

Our UI/UX designers craft an intuitive, user-friendly interface to simplify the loan application, approval, and management process. The platform is optimized for both desktop and mobile devices, ensuring a seamless experience for all users.

Security & Risk Management

For decentralized and automated lending, we create secure smart contracts to govern the loan process, including disbursement, interest calculation, and repayment. We also integrate third-party services such as payment gateways, identity verification, and credit scoring APIs.

Launch & Post-Launch Support

After development and thorough testing, we launch the platform. Post-launch, we provide ongoing monitoring, updates, and support to ensure smooth operations and continuous improvements based on user feedback.