- Sector Expertise

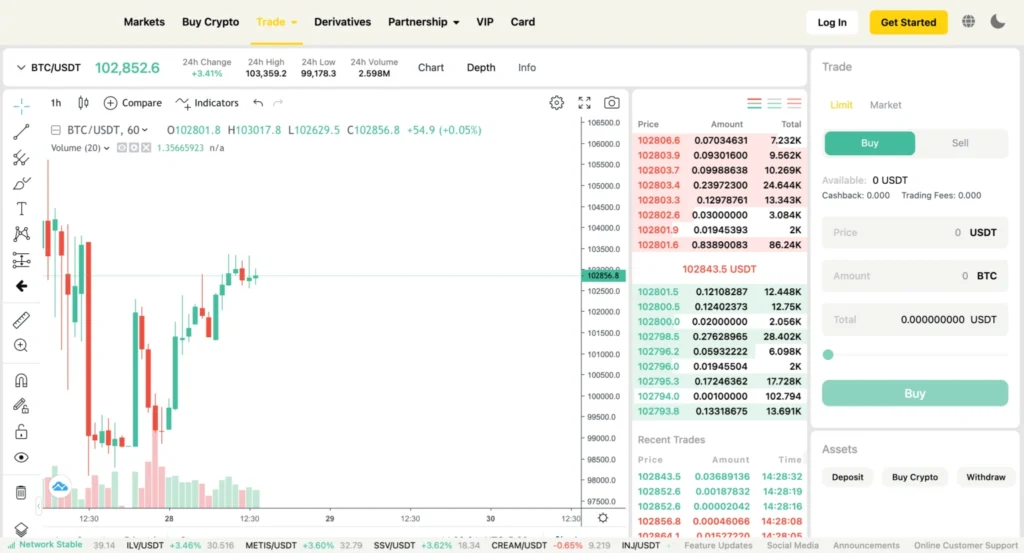

Digital Banking Platforms

We develop secure and scalable digital banking platforms that provide seamless experiences for customers, including mobile banking apps and internet banking portals.

Payment Gateway Integration

Our team builds and integrates robust payment gateways that support real-time transactions across various currencies and payment methods.

Core Banking Solutions

We modernize and enhance core banking systems to improve operational efficiency and enable faster service delivery.

Lending and Credit Platforms

We design custom lending and credit management solutions, automating processes such as loan approvals, credit scoring, and disbursements.

How we help

Our Banking Solutions empower financial institutions to:

Deliver seamless and intuitive banking services across digital channels.

Automate workflows and improve backend processes with modernized systems.

Stay ahead of regulatory requirements with integrated compliance solutions.

Protect sensitive customer data with enterprise-grade encryption and fraud detection systems.

100+

1M+

Our process

Understanding Your Banking Requirements

We start by discussing your specific banking needs, whether it’s for retail banking, corporate banking, or digital banking solutions. This step helps us understand the services you want to offer and ensures the solution aligns with your business strategy and customer demands.

Regulatory & Compliance Analysis

We ensure that your banking solution adheres to industry regulations and compliance standards, such as KYC, AML, and PSD2. This ensures that your platform is secure, trustworthy, and legally compliant, protecting both your business and customers.

Architecture Design & Technology Selection

Our team designs a robust and secure architecture for your banking solution. We choose the appropriate technologies and frameworks that provide high scalability, security, and performance to handle sensitive financial data.

Core Banking System Development

We develop core banking functionalities, including account management, payments processing, loan servicing, and financial reporting. We ensure the solution integrates seamlessly with existing systems and supports a wide range of banking services.

User Experience & Interface Design

We design user-friendly interfaces for both customers and banking staff, ensuring easy navigation and access to services across web and mobile platforms. Our goal is to enhance customer satisfaction and improve operational efficiency.

Testing, Deployment & Ongoing Support

After rigorous testing for security, performance, and usability, we deploy the banking solution. We offer continuous support, updates, and enhancements to ensure the platform remains secure, compliant, and aligned with your business needs.